If you’ve ever turned off an electronic device and noticed that an LED took additional time to go dark, you’ve experienced one of the inevitable challenges of electrical engineering: how to keep things from breaking due to the inherent physical limitations of their designs. Electronic circuits are veritable cities of lights, sounds, flows, resonances, and vibrations. Solving the consumer’s problem with any given design while creating something that will be robust to its operating environment is a surprisingly difficult and nuanced challenge.

Buttons

Consider the humble button.

You press a button and something happens. If you could look inside the electronic circuitry driving that button and see the flows of electricity and the software which handle it, you would find a surprisingly high level of complexity. In software, we would see a variable go from having a value of “0” to having a value of “1”. But software lives in a kind of manufactured digital unreality which is a convenience crafted by the blood, sweat, and invariably, tears of the unsung electrical engineers under the hood.

Follow me on a journey into this world of electronics. I promise to tell you how it pertains to central banking.

A button is ultimately an electronic switch. In one state, the flow of electricity cannot take place and in the other, it can. There is often a mechanical spring or other physical mechanism which prevents the switch from moving until the operator wants it to. A button could be a metal plate suspended above two contact points, for example. When the button is open, no current flows. When the button is pressed, current flows. But the physical reality is much more complex and beautiful than this simple description.

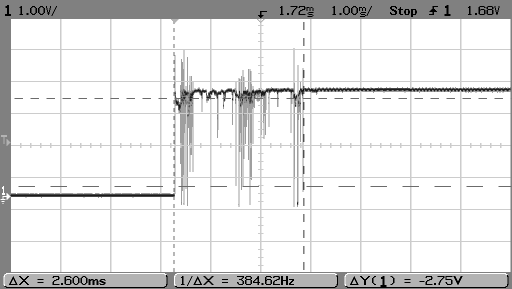

As the metal plate approaches the contacts, unreasonably complicated physics causes changes in the circuit before the metal plate even makes contact. Once it does make contact, it may physically disconnect and reconnect a number of times before settling in to the new position. After all of the chaos has transpired, the wires, contacts, and metal plate form one continuous circuit and are indistinguishable from a continuous wire. The software engineer sees X=0 change to X=1 but the electrical engineer sees something like this.

This can happen for a variety of reasons but ultimately it is a fairly solvable problem. The solution is called debouncing and can be conducted in a variety of ways. One solution which can be implemented in software or hardware is to put a low pass filter between the physical signal and the software signal. The basic operation of a low pass filter is to avoid trusting new values for the signal until enough new values corroborate that value. When the circuit sees its first transition from “0” to “1”, it doesn’t immediately react. It essentially waits until it has seen enough additional “1” values before committing the software variable to move to “1”. Eventually, the circuit trusts that it has seen enough oneness to believe the button has actually been pressed and then provides X=1 to the underlying software. If, on the other hand, the circuit returns quickly to “0” at the physical level, the software never sees X=1 and the circuit assumes that the transient “1” value was an anomaly. This increase in confidence of the button press comes at the cost of a delay in the reaction time. It takes time for the low pass filter to provide software with a guarantee that the button has actually been confidently depressed and isn’t just an electrical anomaly.

PID Controllers

Another incredible technique from control theory is PID control. The basic description of a PID controller is it is a process which tries to maintain a variable at a fixed value but does not do so rigidly. Rather, it glides the variable back to that value after any deviation from its setpoint and it does so over a period of time. Example PID controllers are the thing that keeps an elevator exactly level with the floor despite how many people get on or the propeller thrust of a drone. Elevator cables stretch. Drones experience wind. PID controllers compensate.

PID controllers have an inbuilt sense of anxiety. That is to say, if they deviate slightly from their setpoint, they move back toward it relatively casually but if they deviate significantly, they try to get back more aggressively. Depending on the underlying physical reality being modeled, this can be a source of numerous engineering challenges.

Underdamped, overdamped

The characteristic motion of a variable back to its desired setpoint is called damping. PID controllers try to model their underlying physical reality (eg. inertia) through this mechanism. The inertia of an elevator is prodigious so its PID controller would require one level of damping whereas a 300 gram drone has an entirely different inertia and would require an entirely different level of damping.

When a PID controller is overdamped, it takes too long to return to its setpoint. Consider a person getting into an elevator with a heavy beverage cart. An overdamped PID controller would see the floor of the elevator sag and would take several seconds to return the elevator’s floor to be level with the building’s floor. In the mean time, people exiting the elevator could trip as they try to step up to get on their floor. Lawsuits ensue. An overdamped drone which is upset by the wind would tend to fly off in the direction it leans rather than re-level itself in place.

Underdamping is also a problem and can have potentially disastrous consequences for physical systems. An underdamped elevator would try to return to floor level far too quickly and could put undue strain on the motor, or worse, could actually move too quickly and launch the passengers upward toward the ceiling. An underdamped drone would wobble out of control and crash.

Central Banking

“What does any of this have to do with central banking?!,” I hear you reasonably ask.

International monetary flows are physical realities whose dynamics are very difficult to see. Nevertheless, they experience inertia, have momentum, create pressure, and in many other respects resemble the flow of electricity through a circuit. In electronic circuits, things happen very fast — on the order of microseconds. This is both a problem and an advantage. The problem is that we don’t have much time as engineers to deal with changes. The advantage is that we can build tools like oscilloscopes to see these changes. They repeat at a high frequency which the oscilloscopes can capture. Once we can visualize the undesirable dynamic in our design, coming up with a solution is often a matter of course.

Flows in the international monetary system happen at a glacial pace by comparison and, unfortunately, there are no international monetary oscilloscopes we can use to see the oscillations and perturbations with any fidelity. Even though we can’t see the complex and beautiful dynamics, they are, nevertheless, always there.

The button in the case of monetary policy is the US Federal Reserve’s recent rate hike. On time scales which are relevant to monetary policy, it’s as if they pressed a button which launched a highly underdamped PID controller into action. Or, maybe, we’re still in the bounce of the button press.

Based on their press conference last month, they appear to have broken something. Likely, some key metric has overshot their target and their dovish pivot is their underdamped response. The oscillations which are taking place in the international financial plumbing have incredibly low frequencies and long periods. Whereas electronic systems have oscillations at the microsecond scale, oscillations in something as large as the international financial plumbing of the world have periods measured in months or years.

Like a brand new driver experiencing a turn at an uncomfortably high speed, the Fed is oversteering the global financial system into the next crisis. Beyond recognizing that these oscillations are beginning to take place, the ultimate outcome of this dynamic is anyone’s guess. Worse, most of the observers of these dynamics will linearize the data they’re seeing. As friend of Liberty Papers, Doomberg said in their excellent recent conversation with Adam Taggart of Thoughtful Money, “People in the industry are notorious for drawing tangent lines to sine waves.” This was applied to the oil and gas industry in that conversation but the same risk exists for observers of macroeconomic phenomena.

The Federal Reserve has set off a huge, slow, and powerful oscillation which they are ill equipped to control. What will break next? I’m afraid we’ll find out soon. Unfortunately, soon could be months or years away. By the time the crisis recently set into motion arrives, very few people will be able to connect the causality back to the actions policymakers are making today. New mistakes will be made which will set into motion new oscillations, ad infinitum.

As an electrical engineer, this makes all kind of sense to me. From the beginning, the Fed’s track record has been horrible. The financial system is just too complex and chaotic to be centrally managed. IMHO, we would be better off without central banks and went back on the gold standard.

I've often thought that the most useful academic course I've ever taken was intro to controls as an undergrad. I'm always surprised at the sheer volume it applies to in the real world.